When people ask

about your kids, what do you tell them?

More than likely, you tell them about the teams they play on, the

activities they’re involved in, their progress in school and their

accomplishments, right? My kids are

older so I talk about the success they have found in their careers.

One of my twins

is a successful banker. His brother has worked for a growing software company

for the last decade or so. I am very

proud of them. They are both moral,

do-the-right-thing people.

Despite their

focus on succeeding at business, I don’t think of them as greedy. I think of them as successful.

The media

focuses our attention on the 1%, the billionaires whose wealth is beyond the

dreams of most people. I think it’s important

to get past the headlines. Most of the wealthy got where they are by creating

value through a product or service they invented and/or sold or by risking

their personal capital in an enterprise with potential.

The big thinkers

at Amazon and Google transformed the way we buy things and became billionaires

in the process. Warren Buffet studied

investment and became one of the world’s richest men. The innovations of Thomas Edison, Henry Ford

and J. Craig Venter have all improved our lives and made them wealthy.

If you read the

business news you might conclude there is money to be made through innovation

in energy production, 3D printing and biotechnology. Some will get very wealthy. That’s how our economy works. Someone develops a product or service that

consumers value and wealth is created.

If one of your

children made millions in stock options by working for one of these companies, would

you think they were greedy? Or, would you

be proud of their success?

And, yet there

is an undercurrent of intellectual dialog that crops up everywhere from the

Sunday morning talk shows to LinkedIn discussions that describes the very

wealthy as greedy.

Princeton University is hosting

an art exhibit titled “Exhibition to spotlight the environment, corporate greed and consumerism”.

Bloomsbury USA has published a children’s book titled “Pandora Gets Greedy” about the exploits of a young girl who searches for greed in the time

of the Roman Empire.

Since our founding, Americans have struggled to achieve a balance between

freedom to pursue our own ends and a virtuous society. Jonathan Edwards, writing in The Freedom of

the Will (1754), insisted that people are free because they pursue what’s in

their own best interest. But, he pointed

out that human will could be corrupted by pursuing the apparent good for

oneself at the expense of the apparent good in God.

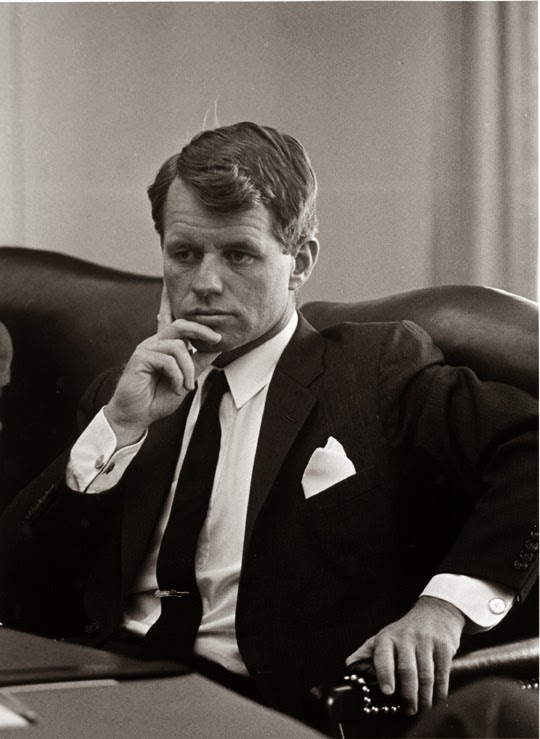

More recently, Robert Kennedy warned against a singular focus on GNP

[Gross National Product]. Speaking a few months before his assassination, he pointed out that GNP “does not include the

beauty of our poetry or the strength of our marriages, the intelligence of our

public debate or the integrity of our public officials. It measures everything, in short, except that

which makes life worthwhile….”

Can we teach that lesson to our children without undermining their

professional and financial success?

The political speech that emanates from the dogma of the left and right

will not help us understand how best to create a just society. The liberal egalitarian view seeks to achieve

equality by redistributing wealth. The

conservative libertarian view says we must respect freedom of choice. If my choices lead to economic success and

yours lead to starvation, so be it.

In the end, the extreme libertarian view flies in the face of our

Christian or humanist instincts.

However, the extreme opposite view – that wealth should be appropriated

for the good of those less fortunate – undermines our economic prosperity and

the value of hard work.

Wealth is not, in and of itself, evil. To describe those who attain it as greedy

ignores the positive impact of our prosperity.

To be sure, if you

are reading this post on your iPad while sitting in Starbucks, you are enjoying

the fruits of a society built on capitalism. If you still have your teeth after

age 60, have two cars in the garage and have time to play with your children,

it is because of the value created by innovation and enterprise since the

founding of our nation.

So, is it progress or is it greed?

WHO WILL LEAD?

WHO WILL

LEAD?

If your premise were correct that " Most of the wealthy got where they are by creating value through a product or service they invented and/or sold or by risking their personal capital in an enterprise with potential," it would be progress. But my understanding is that is not the case. Some of the wealth comes from inheritance -- think Paris Hilton. I am not sure of the numbers but think it might be around 25%,

ReplyDeleteThere is another more subtle problem. Wealthy children grow up in families where they learn business from their parents and are given advantages both in terms of learning, funding and contacts. For example I have read that Donald Trump's father, Fred Trump, was a real estate tycoon who sent him to private schools, taught him the business and left him $200 million.

This is not a level playing field.

Make money through your own intelligence and drive is wonderful. The problem is that many people come to believe that it's all due to their own efforts and discount the effect of family and privilege.

Charlie Kreitzberg

Who says life should be "level" across the board? Certainly a society that embraces productive achievement will prosper more than a society that embraces tribal warfare or "witch-doctor" mysticism as a means to prosperity. Should the posterity of the "productive" society be stripped of the products and efforts of their forefathers and have to start from scratch with each new generation? Of course they shouldn't, thats just stupid. Why then do we entertain the notion that this should occur on a micro-level at the family? Those who worry about the concept of "fair", particularly while pontificating about what is or isn't fair on the internet, should think about their blatant hypocrisy when utilizing a computer that was built by what would be considered slave wages in Western Culture. You can't claim "fairness" yet stop at the border. How fair is it that someone be born in Afghanistan, a young girl, compared to the young girl who grows up in the inner city in the USA? And on the subject of "fairness" or a "level playing field", who determine that standard, and by what right do they have to impose their "belief" on me?

Delete@Charlie. So, do you conclude that it's not progress, it's greed? Are those who inherit money greedy by definition?

ReplyDeleteYou've responded to a different question and not answered the core question: what should we teach our children?

As for the question you have (partially) answered, I would suggest that many people work to develop an estate that they can leave to their family. Paris Hilton may not, in your opinion, be deserving of part of Conrad Hiltion's fortune. Even if that is true, would you apply that to all people who inherit wealth? Should heirs be deprived of their family's inheritance. Should the after-tax earnings of one's forebears be taxed again in the name of ......? What exactly?

Peter Calia If I can be so bold, teach them both as I have been taught. Teach them it's ok to earn a dollar ethically and never be ashamed of success but also give back what you can, whether a combination of time, money, and generosity to those less fortunate than yourself. I believe our political views vary depending on the topic and experience. Great article as always Dad.

ReplyDeleteDaniel Calia Agreed Peter. I've come to realize through the years that life is simply too short. Take advantage of what America has to offer but do it with your ethics and values in tact. Then if you fail, because you will, then you know you tried with the right foundation in place. Then you build upon those experiences. You will sleep better at night and move on to the next big opportunity. Foundation is everything.

ReplyDeleteBrian Grubbs

ReplyDeleteVice President at Montague Derose and Associates

I think it's progress. The voices calling it greed are the same people who like to stoke the class warfare over and over again. Of course you've seen this more times than I have. I actually feel sorry for their consistently pessimistic view of life. How much money is too much? Easy, its usually about $100k more than I make right. How big of a house if too big? Easy it's one that is 1000 sq feet larger than mine. Hypocrisy!

I don't think the extreme libertarian view is against Christian views since Christians would part with their money voluntarily to help those in need.

Brian Grubbs

ReplyDeleteVice President at Montague Derose and Associates

On another note, It would be interesting to look at Facebook users and see if you could see what demographic patterns you could find out about those who post about their kids regularly vs those that don't but from time to time. The issue being that no one is asking about their kids, but instead they feel a need to post very regularly.

Carl Amiaga

ReplyDeleteOwner, Temps Unlimited, Inc

The class warfare strategy of many politicians and media sources is very destructive and anti-Christian. Charitable giving is noble but confiscation of wealth is amoral. Class warfare promotes envy and encourages materialism. It is not wrong to accumulate wealth but wealth does not lead to happiness or fulfillment. Both the wealthy and the poor should come to grips with that fact.

It is very sad that those who are financially successful are automatically termed greedy. There are plenty of greedy people in all economic classes. Let's celebrate success and use that as a goal for everyone.

Sean McGinty, MBA

ReplyDeleteQuality Management Professional | Process Improvement | Operations Management | Seeking Position

We've all heard the proverb, "Give a man a fish, feed him for a day. Teach a man to fish, feed him for a lifetime." There is a cynical corollary to that proverb that says, "Give a man a fish, and in no time you'll have a line of people out the door wanting free fish." I like to think that most people would prefer to be self sufficient, but I know from personal experience that if your struggles last long enough, and the obstacles you face are difficult enough, it becomes very tempting to take the path of least resistance, even if that means a life of dependency and subsistence.

The class warfare that we see in America is particularly corrosive because in many cases it seeks to magnify the obstacles that people at the bottom of the economic ladder face while insinuating that the people at the top were somehow able to bypass those obstacles. The message that, "Your life is hopeless unless you let us help you," flies in the face of our centuries long tradition of self reliance and innovation.

Government certainly has a role to play in preparing people to find opportunities and to take advantage of them. As someone who has been collecting unemployment I also appreciate the fact that a reasonable safety net exists. The fact that there is an end date to that safety net was certainly a factor in motivating me to aggressively pursue a job search. When the government provides resources and incentives for individuals to become productive contributors to society and the economy, they are acting in our best interest. When they coddle people and provide disincentives to become productive we need to make a change.

Corporate bailouts also serve to accentuate the differences between the haves and the have-nots. When an individual makes bad decisions and loses a lot of money, the government does nothing. When a major corporation does the same thing, the government gives them loans and waives legal penalties and sanctions. It's no wonder the guy who is struggling to keep from having his electricity turned off thinks the rich don't have to play by the same rules.

Eric Hulbert

ReplyDeleteConsumer Prod Strat Analyst at Bank of America

I do not think there needs to be a distinction between progress and greed. If you build a better mousetrap I do not think your motivation is important, it still improves the lives of others. If someone competes in the marketplace fairly and wins, good for them getting rich, that is what is supposed to happen.

I do not think there would be nearly the kind of discussion about inequality we are seeing now if the capitalist system was functioning properly and there were consequences for bad behavior. People feel the pain of foreclosure, whether it hit them or hurt their property values, but then they see the other side where no one important went to jail over fraudulent actions leading to the financial crisis, and most of the worst offenders are still rich. It was not always this way, Jeff Skilling and Michael Miliken went to jail. However these days Angelo Mozilo is probably playing golf with Franklin Raines, Dick Fuld and the people from HSBC.

Steven Whittle

ReplyDeleteAnalyst at Department of Defense

I think that people like to play with words. If we are to understand "selfish" to be "concerned with one's own interests" as opposed to "childishly grabby" it takes on a whole different character. Today, people think in terms of "childish" when they think of both "greed" and "selfish." The facts are that one cannot effectively aid one's fellows until he has secured his own position. Once he has taken care of himself (acted "selfishly") then he can attend to others. Being concerned with yourself first is ultimately rational.

Karen Papazian

ReplyDeleteDirector, Dealer Lending Operations at Toyota Financial Services

This is a great post. A lot to think about. We do live in a society where you are often made to feel guilty for being successful financially. I worry about encouraging my young children to develop a strong work ethic when their own success might someday be questioned such (but I encourage them anyway...). Thank you for being thought provoking.

Chuck Rosselle

ReplyDeletePortfolio Manager at U.S. Nuclear Regulatory Commission

The topic of wealth inequality has been given a boost recently by economist Thomas Pinketty’s book “Capital”. It’s pretty dense and the proposed solution to wealth inequality, namely a global “wealth tax”, is a likely non-starter but the research and findings are pretty eye opening. Pinketty convincingly demonstrates that the wealth inequality we see today is actually the historic norm. A significant re-distribution of wealth throughout the middle class only occurred for 45 years or so; ending in the 1970’s. Further, his research demonstrates that the overwhelming source of personal wealth creation is asset ownership and appreciation, not rewards for personal excellence or successful economic activity. The cliché “the rich get richer” really is true.

Most harbor no resentment for those that are rewarded financially for personal excellence or successful economic performance. Resentment arises when there is perceived or apparent favoritism towards the wealthy or if opportunities for self-improvement appear limited. These are relative concepts; there will always be some favoritism just as there will never be enough opportunity to satisfy everyone. Society therefore must determine what constitutes acceptability and what to do when an unacceptable situation occurs. I would argue that the recent experience with more widespread wealth distribution automatically makes the current level of wealth inequality societally unacceptable. The unanswered question thus becomes what to do about it.

The simple solution for wealth equality is the elimination of perceived or apparent favoritism towards the wealthy. Everything from progressive taxation to the French Revolution is a reflection of this trend. Most of these solutions eventually become unwound; what appears as favoritism to a man with no means is only what is just to that same man when he acquires means. Indeed the English system of jurisprudence, which we’ve inherited as Americans, is largely built on a legal foundation of strong protections for private property. More lasting solutions are those which widely increase available opportunities for self-improvement. We have a basis for such solutions in this country. We need to strengthen it.

Ever since the current economic downturn, there has been a national obsession with the quest for jobs. Implicit in this obsession is often a presumption that the right set of circumstances will recreate the fortunate employment scenario that led to widespread middle class American job prosperity in the 1950’s. It is worthwhile to seek such employment prosperity and important to recognize that the current global economy no longer supports the American economy of that era. The hard work of identifying and building a prosperous American jobs economy for the future is still in progress. During this transition Americans still need to prosper without government assistance. Many have and will continue to do so largely through the benefits afforded by widespread, middle-class asset ownership and appreciation.

Widespread home ownership supported by the fixed price thirty year mortgages is a unique and highly successful American phenomenon. Despite 2008 shortcomings, home equity still comprises the single greatest component of wealth for the majority of Americans. Mutual funds, access to on-line, low priced brokerage accounts and the growth of 401K programs dramatically increases access to financial markets. Securitization provides low cost access to modest sums of capital. The so-called “sharing economy” creates diverse opportunities for revenue generation. These initiatives provide potential financial independence for a wide swath of responsible Americans. We need to broaden and strengthen them in order to create greater economic diversity.

Sean McGinty, MBA

ReplyDeleteQuality Management Professional | Process Improvement | Operations Management | Seeking Position

I have a hard time seeing the point of view that wealth inequality is a problem that needs to be solved. When we have a growing population of middle class, blue collar workers who have personal net worths in excess of one million dollars I question the premise that you have to be rich to get rich. These people generally managed to accumulate their wealth through careful money management and conscientious, systematic saving and investing. Many of them never saw their household income hit $100,000.

Any scheme that would seek to confiscate and redistribute wealth would severely hamper wealth creation. Despite popular wisdom, the pie does keep getting bigger, largely due to investments and risk taking by people with money. They do this by starting business ventures, by investing in bonds and equities, or just by depositing money in a bank and making it available for loans. If we cap personal wealth, rich people might as well use some of their excess wealth to have a high security safe built in their home, and then put the rest of their money there. Wealth equality takes away incentives to grow wealth.

Even supposing the system doesn't create disincentives for people to grow their personal wealth, if we spread all the wealth uniformly, we get a uniformly lower rate of growth in the total wealth of the nation. In general, larger investments reap larger rates of return. $1 million grows at a faster rate than does $50 thousand. That's part of the reason the rich get richer. Banks pay higher interest rates on $500 thousand savings accounts that they do on $5,000 accounts, and a business started with $1 million in capital will usually grow faster than a similar business started on a shoestring.

The progressive tax code actually penalizes the wealthy. It's hard to argue that someone paying taxes on a $1 million per year income receives 97 times more benefit from the federal government than a person paying taxes on $50,000, but that's what our tax system says is fair. "Pay as you are able," appeals to a sense of charity and fairness, but it really isn't equitable. Any tax breaks that apply primarily to the rich only serve to reduce this inequity.

Our tax codes and economic policies should focus on making it easier for poor, low income people to build their personal income and wealth through their own efforts and investments, and forget about trying to figure out how to do it on the backs of the people who've already achieved economic success.

I really enjoy your writing. I've lived in the cauldron of modern liberalism/progressivism now for 3 years (LA). Your take is spot on, except that IMHO what the left is doing is even more sinister than your post lets on. And if they achieve their ambitions, my kids are screwed. Trickle up poverty never ends well.

ReplyDelete